Ever felt that mix of excitement and anxiety when you’re about to buy a new car? You’ve picked out your dream ride, but now you’re faced with the daunting task of financing it. Understanding car loan interest rates is crucial to making a smart purchase. Let’s dive into the world of auto financing and uncover what determines the average interest rate on a car loan.

Decoding Car Loan Interest Rates

What Exactly Is an Interest Rate?

Think of an interest rate as the cost of borrowing money. It’s like paying rent for the cash you’re using to buy your car. The higher the interest rate, the more you’ll pay over the life of your loan.

For example, if you borrow $30,000 at 5% interest for 5 years, you’ll end up paying about $3,968 in interest over the life of the loan. But if that rate jumps to 7%, you’re looking at $5,642 in interest. That’s a difference of $1,674 – enough for a nice vacation or some sweet upgrades to your new ride!

Factors Influencing Your Car Loan’s Interest Rate

Several key factors determine the interest rate you’ll be offered:

- Credit score: This is the biggie. Your credit score is like your financial report card, and it significantly impacts your interest rate.

- Loan term: Generally, shorter loans have lower interest rates but higher monthly payments.

- New vs. used vehicles: New cars often come with lower rates as an incentive.

- Current economic conditions: The overall state of the economy affects interest rates across the board.

- Lender competition: More competition among lenders can lead to better rates for borrowers.

Current Average Interest Rates on Car Loans

Breaking Down the Numbers

As of 2024, the average interest rate on a car loan in the US hovers around 7.5% for new cars and 11.5% for used cars. But remember, these are averages – your rate could be higher or lower depending on your individual circumstances.

Let’s break it down further:

| Loan Type | Average Interest Rate |

| New Car | 7.5% |

| Used Car | 11.5% |

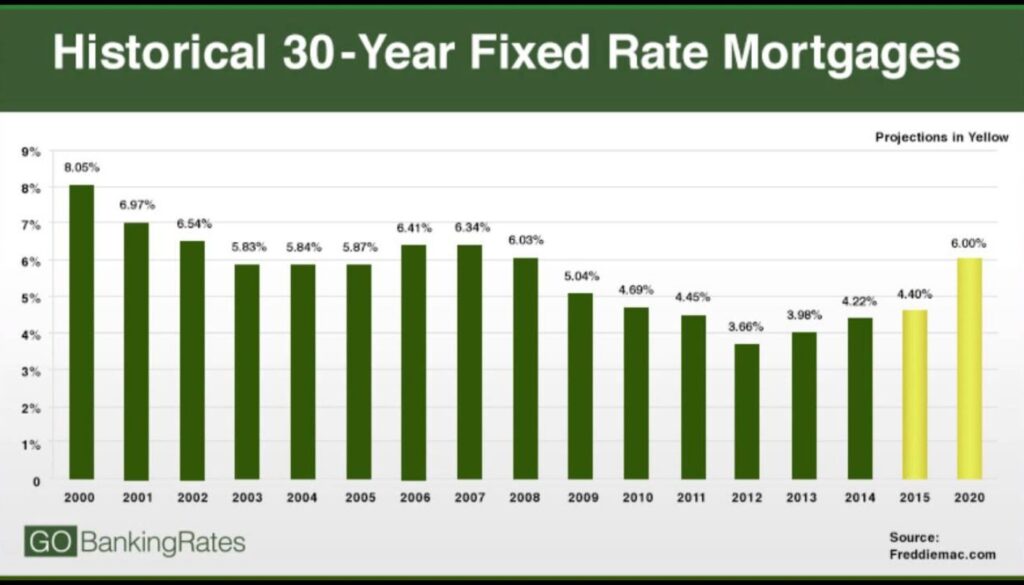

Historically, these rates are on the higher side. In the early 2020s, we saw rates as low as 4% for new cars and 8% for used cars. The increase reflects changes in the broader economic landscape.

Interest Rates by Credit Score Ranges

Your credit score plays a massive role in determining your interest rate. Here’s a rough breakdown:

| Credit Score Range | Average New Car Rate | Average Used Car Rate |

| Excellent (750+) | 5.5% | 8.5% |

| Good (700-749) | 6.5% | 10% |

| Fair (650-699) | 8.5% | 13% |

| Poor (below 650) | 12%+ | 18%+ |

What do these numbers mean for you? If you have excellent credit, you could save thousands over the life of your loan compared to someone with poor credit. For instance, on a $25,000 loan over 5 years, the difference between a 5.5% and 12% interest rate is about $4,500!

How Car Loan Interest Rates Compare to Other Loans

When considering how to finance your car, it’s worth looking at other loan options. Here’s how they stack up:

| Loan Type | Average Interest Rate | Pros | Cons |

| Car Loan | 7.5% – 11.5% | Specifically for cars | Car can be repossessed |

| Personal Loan | 10% – 28% | Can be used for anything | Higher rates |

| Home Equity Loan | 5% – 7% | Lower rates, tax-deductible | Risk losing your home |

While a home equity loan might offer the lowest rate, remember that you’re putting your house on the line. A car loan is often the most straightforward and safest option for most buyers.

Tips to Secure the Best Interest Rate on Your Car Loan

Before You Shop

- Check and improve your credit score: This is your ticket to better rates. Pay down debts, correct any errors on your credit report, and avoid applying for new credit before car shopping.

- Save for a larger down payment: The more you put down, the less you need to borrow, which can lead to better rates.

- Research current average rates: Knowledge is power. Know what rates you should expect based on your credit score and the type of car you’re buying.

During the Car Buying Process

- Shop around for loans: Don’t just take the first offer. Check with banks, credit unions, and online lenders. Many offer pre-approval without affecting your credit score.

- Consider loan term carefully: While longer terms mean lower monthly payments, they often come with higher interest rates and cost more in the long run.

- Negotiate the interest rate: Yes, you can negotiate! If you have offers from multiple lenders, use them as leverage.

- Be wary of dealer financing tricks: Watch out for low monthly payments that hide high interest rates or extended loan terms.

“The best way to get a good deal on a car loan is to be an informed consumer. Know your credit score, understand average rates, and don’t be afraid to negotiate.” – Financial advisor Jane Doe

The Impact of Interest Rates on Your Car Budget

Crunching the Numbers

Let’s look at how different interest rates affect the total cost of your car loan. We’ll use a $30,000 loan over 5 years as an example:

| Interest Rate | Monthly Payment | Total Interest Paid | Total Cost |

| 5% | $566 | $3,968 | $33,968 |

| 7% | $594 | $5,642 | $35,642 |

| 10% | $637 | $8,184 | $38,184 |

As you can see, even a small change in interest rate can have a big impact on your wallet. That’s why it’s crucial to shop around and negotiate for the best rate possible.

When to Refinance Your Car Loan

If you’re stuck with a high interest rate, don’t despair. Refinancing could be your ticket to savings. Consider refinancing if:

- Your credit score has improved significantly since you took out the loan

- Interest rates have dropped since you financed your car

- You’re struggling with high monthly payments and need to extend your loan term

Case Study: Sarah’s Savvy Refinance Sarah bought a car with a 10% interest rate due to fair credit. After two years of on-time payments, her credit score improved. She refinanced at 6%, saving $50 per month and $2,000 over the remaining life of her loan.

Future Trends in Car Loan Interest Rates

Economic Factors to Watch

- Federal Reserve policies: The Fed’s decisions on interest rates ripple through the entire economy, including car loans.

- Auto industry health: If car sales slump, we might see more competitive rates to encourage buying.

- Consumer trends: Shifts towards electric vehicles or car-sharing could impact loan offerings.

Keep an eye on these factors to anticipate changes in car loan interest rates. Being informed can help you time your purchase to get the best deal possible.

Conclusion

Understanding the average interest rate on a car loan is just the beginning. Your personal rate will depend on a variety of factors, most importantly your credit score and the current economic climate. By arming yourself with knowledge and following the tips we’ve discussed, you’ll be in a great position to secure the best possible rate on your next car loan.

Remember:

- Check your credit score and work on improving it

- Shop around for the best rates

- Don’t be afraid to negotiate

- Consider refinancing if your situation improves

With these strategies, you’ll be cruising down the road in your new car, secure in the knowledge that you got a great deal on your loan.

Additional Resources

For more information on current car loan rates, check out:

Glossary of Car Loan Terms:

- APR: Annual Percentage Rate, the yearly cost of your loan including interest and fees

- Loan term: The length of time you have to repay the loan

- Down payment: The initial payment you make when purchasing a car

- Comparison rate: A rate that includes both the interest rate and fees, giving you a more accurate picture of the loan’s cost

By understanding these terms and the factors that influence car loan interest rates, you’re well-equipped to make a smart, financially savvy decision on your next auto purchase. Happy car shopping!

Marathi author Anju Mary has made a mark in the literary world with her innovative storytelling and deep passion for reading. Her unique narrative style and creative approach offer readers a distinctive and enriching experience, solidifying her reputation as a prominent writer.