Life’s a rollercoaster is not it? One minute you are fresh out of college, the next you’re planning a wedding or eyeing that dream house. But here’s the kicker: each of these milestones comes with a price tag. Don’t sweat it, though! We’re about to dive into the art of budgeting for life’s big moments.

Know Before You Hire: Key Medical Conditions Found in Pre-Employment Screenings

Ever wondered what employers are looking for in those pesky pre-employment health checks? It’s not just about passing a drug test. Some companies dig deeper, screening for conditions that could impact job performance or safety. Heart disease, diabetes, and even mental health issues might pop up on their radar. But don’t panic! Knowledge is power, and being prepared can help you navigate this process like a pro.

The Art of a Perfect Smile: Exploring Cosmetic Dentistry

Who doesn’t want a million-dollar smile? Cosmetic dentistry isn’t just for Hollywood stars anymore. From simple whitening to full-on veneers, there’s a world of options to brighten your pearly whites. But here’s the rub: these procedures can cost a pretty penny. That’s where smart budgeting comes in handy. Start saving early, and you’ll be flashing that dazzling smile in no time!

Unveiling HIFU: How Ultrasound Waves Renew Your Skin

Looking for the fountain of youth? High-Intensity Focused Ultrasound (HIFU) might be your ticket. This cutting-edge treatment uses sound waves to tighten and lift skin, no surgery required. It’s like turning back the clock without going under the knife. But remember, beauty doesn’t come cheap. Factor this into your long-term budget if you’re serious about aging gracefully.

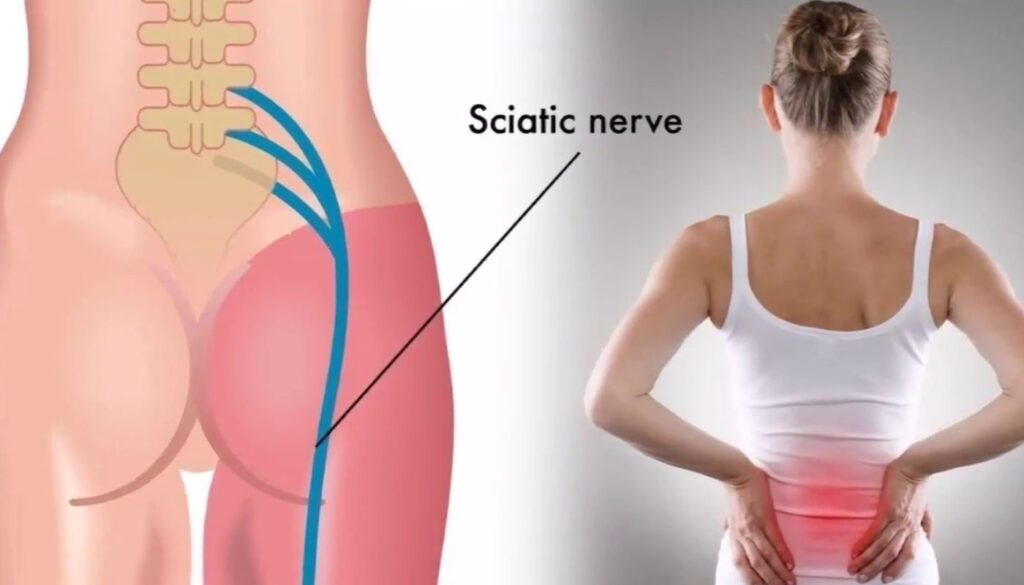

Say Goodbye to Back Pain: Effective Strategies for Lasting Relief

Back pain’s a real pain in the… well, you know. Whether it’s from hunching over a desk or overdoing it at the gym, chronic back issues can put a serious damper on your quality of life. The good news? There are plenty of ways to find relief, from physical therapy to yoga. Some might even be covered by your insurance. Speaking of which…

Best Private Health Insurance in Australia

G’day, Aussies! Private health insurance can be a lifesaver, literally. But with so many options out there, how do you choose? Look for plans that cover what you need most, whether that’s dental work, physio, or specialist care. And don’t forget to compare premiums and out-of-pocket costs. A little research now could save you big bucks down the road.

Loyal American Life Insurance: Cigna

Life insurance isn’t the most exciting topic, but it’s crucial for protecting your loved ones. Loyal American Life Insurance, now part of Cigna, offers a range of policies to fit different needs and budgets. Whether you’re looking for term life or whole life coverage, they’ve got options. Just be sure to read the fine print and understand what you’re signing up for.

Unexpected Kitchen Disasters: How Insurance Can Help?

Picture this: You’re whipping up a gourmet meal, and suddenly your oven goes kaput. Or worse, a small grease fire turns into a big problem. Yikes! This is where home insurance comes to the rescue. Many policies cover kitchen mishaps, from appliance failures to fire damage. But don’t wait for disaster to strike. Review your coverage now and make sure you’re protected.

NRMA House Insurance Quotes in Australia 2024

Calling all Aussie homeowners! NRMA’s been a trusted name in insurance for yonks, and their house insurance is worth a look. In 2024, they’re offering competitive rates and comprehensive coverage. But here’s a pro tip: don’t just go for the cheapest quote. Consider what’s covered, excess amounts, and any extras you might need. Your home’s your castle, after all. Protect it right!

Post Office Travel Insurance: Your Key to a Hassle-Free Journey

Planning a holiday? Don’t forget travel insurance! The Post Office offers solid coverage at reasonable rates. Whether you’re backpacking through Europe or lounging on a beach in Bali, their policies have got you covered. From lost luggage to medical emergencies, they’ve thought of everything. Just remember to book it before you jet off!

Business Travel Insurance: Protecting Your Company and Your Employees

If you’re a business owner sending employees on trips, listen up! Business travel insurance isn’t just a nice-to-have; it’s a must-have. It protects your team and your bottom line from unexpected hiccups like flight cancellations, lost equipment, or medical emergencies abroad. Think of it as an investment in your company’s peace of mind.

Car Safety Precautions for Hailstorms

Mother Nature can be a real menace sometimes, especially when she starts chucking ice from the sky. Hailstorms can turn your shiny ride into a golf ball in minutes. But fear not! A few simple precautions can save you a world of hurt (and a hefty repair bill). Keep an eye on weather forecasts, find covered parking when possible, and consider investing in a hail-proof car cover. Your wallet (and your car) will thank you.

Flow Car Insurance: Revolutionizing Auto Coverage

Hold onto your steering wheels, folks! Flow Car Insurance is shaking up the auto insurance game. They’re all about simplicity, transparency, and fair pricing. No more head-scratching over complex policies or hidden fees. But is it too good to be true? Well, that depends on your needs. Do your homework, compare quotes, and see if Flow’s the right fit for you and your wheels.

Business Income Protection Insurance: Safeguarding Your Financial Stability

Running a business is like riding a roller coaster blindfolded. You never know what’s around the next turn. That’s where business income protection insurance comes in. It’s your financial safety net when the unexpected happens, keeping cash flowing even if you can’t work. Whether it’s illness, injury, or other unforeseen circumstances, this coverage helps keep your business afloat. Don’t let your hard work go down the drain – protect it!

There you have it, folks! A whirlwind tour of budgeting for life’s milestones, with a few detours into insurance, health, and financial protection. Remember, the key to mastering your money is planning ahead and staying informed. So start budgeting, keep learning, and you’ll be ready for whatever life throws your way. Got questions? Fire away! I’m here to help you navigate the twists and turns of financial planning.

Conclusion

Mastering your money isn’t just about pinching pennies—it’s about making smart choices that align with your life goals. From safeguarding your smile to protecting your business, every financial decision shapes your future. Remember, budgeting for life’s milestones is a journey, not a destination. Stay flexible, keep learning, and don’t be afraid to seek expert advice when needed. By planning ahead and staying informed, you’ll be better equipped to handle whatever curveballs life throws your way. So take charge of your finances today, and pave the way for a more secure and fulfilling tomorrow.

FREQUENTLY ASKED QUESTION

- How much should I realistically save for unexpected life events?

Aim to set aside 3-6 months of living expenses in an easily accessible emergency fund. Start small if needed and build up over time.

- Is cosmetic dentistry worth the investment for long-term confidence?

It depends on your personal goals. Consider long-term benefits vs. costs, explore payment plans, and consult with a reputable dentist.

- Can HIFU treatments truly replace traditional facelifts for anti-aging?

HIFU offers noticeable results, but may not match surgical outcomes for severe sagging. It’s a good option for mild to moderate skin laxity.

- How often should I review and update my various insurance policies?

Annually, or when major life changes occur like marriage, new home, or career shifts. Regular reviews ensure you’re always adequately covered.

- What’s the most effective way to budget for business travel insurance?

Factor it into your overall travel budget as a fixed percentage, typically 5-10% of trip costs. Consider annual policies for frequent travelers.

Marathi author Anju Mary has made a mark in the literary world with her innovative storytelling and deep passion for reading. Her unique narrative style and creative approach offer readers a distinctive and enriching experience, solidifying her reputation as a prominent writer.