Checking a car’s insurance status is an essential step when buying a used vehicle, verifying your own coverage, or simply ensuring compliance with local laws. The Vehicle Identification Number (VIN) serves as a unique identifier for every car, making it a valuable tool for accessing important information about a vehicle’s history and insurance status. This article will guide you through various free methods to check car insurance using a VIN number, discuss the benefits of this process, and provide answers to frequently asked questions.

Free Methods to Check Car Insurance by VIN Number

Online VIN Check Databases

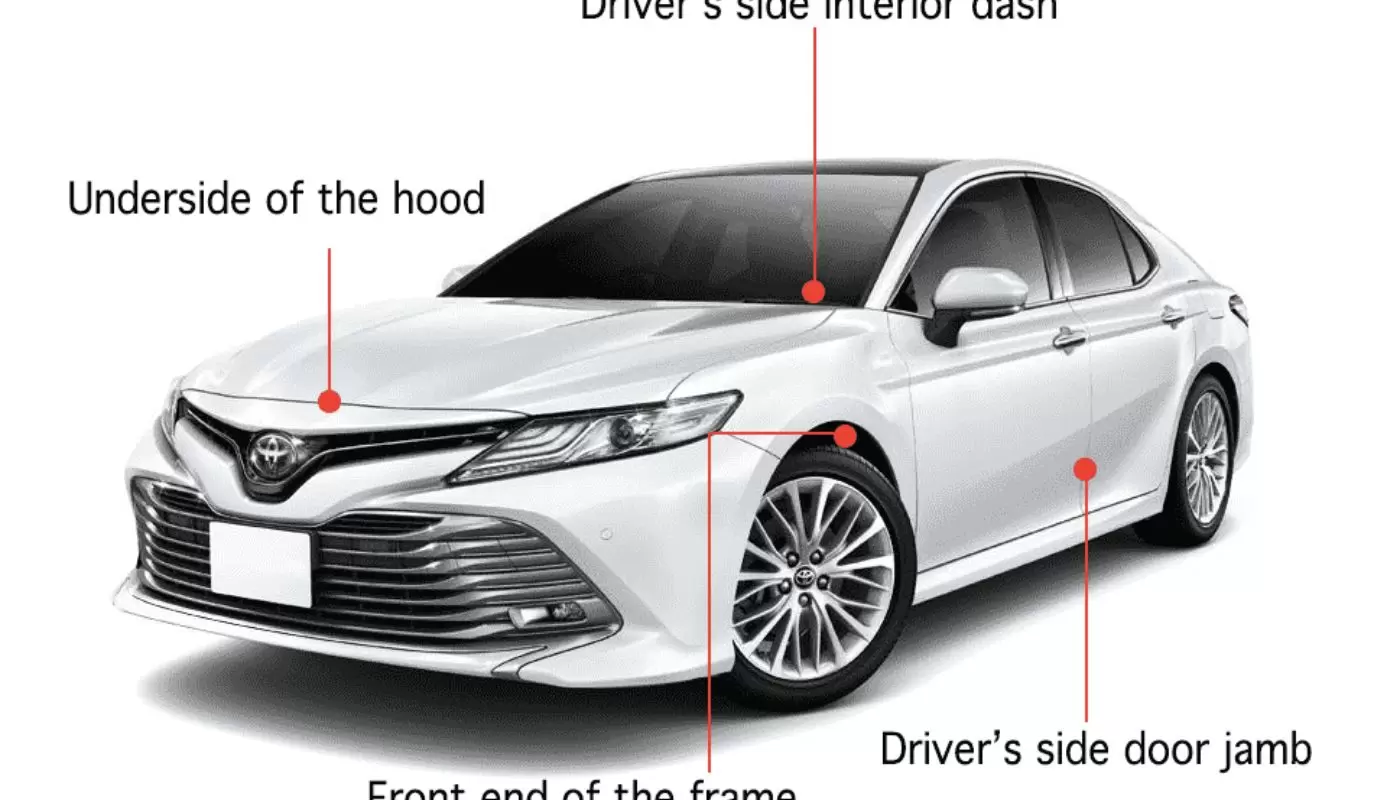

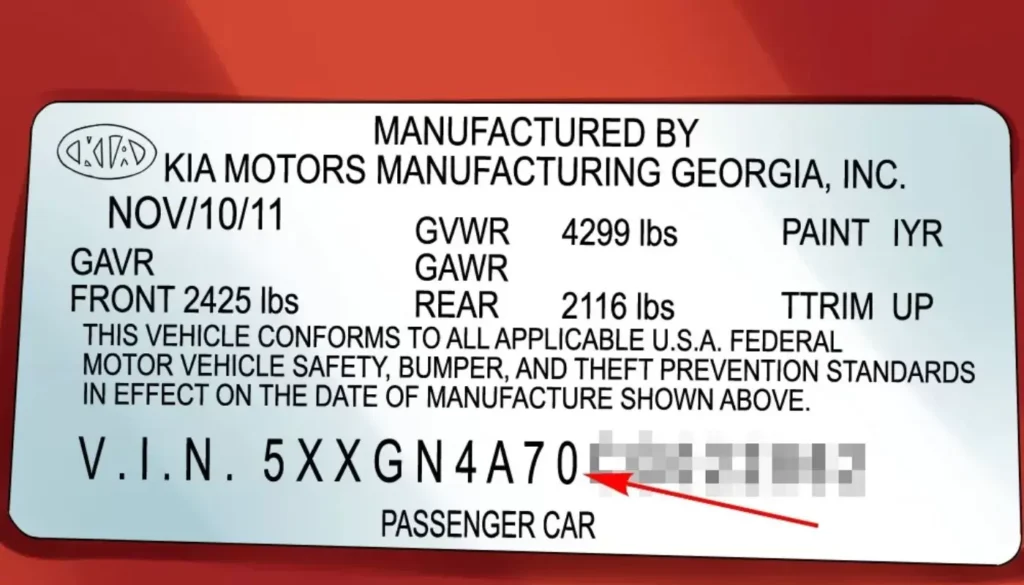

Several websites offer free VIN check services that can provide valuable information about a vehicle’s insurance status. These online databases compile data from various sources, including insurance companies, government agencies, and other public records. To use these services:

- Visit a reputable VIN check website

- Enter the 17-digit VIN in the search bar

- Review the generated report for insurance information

While these free reports may not always include comprehensive insurance details, they can often indicate whether a vehicle is currently insured or has a history of insurance claims.

Insurance Company Websites

Many insurance providers offer online tools that allow you to verify a vehicle’s insurance status using its VIN. This method is particularly useful if you know the insurance company associated with the vehicle. To use this approach:

- Visit the insurance company’s website

- Look for a “Policy Lookup” or “VIN Check” tool

- Enter the VIN and any additional required information

- Review the results for insurance status and policy details

Keep in mind that some insurance companies may require additional information, such as a policy number or the policyholder’s name, to access insurance details.

State Department of Motor Vehicles (DMV) Websites

Many state DMV websites provide online services that allow you to check a vehicle’s insurance status using its VIN. This method is especially useful for verifying compliance with state insurance requirements. To use this approach:

- Visit your state’s DMV website

- Look for a “Vehicle Insurance Verification” or similar tool

- Enter the VIN and any other required information

- Review the results for current insurance status

Some states may charge a small fee for this service or require you to create an account before accessing the information.

National Insurance Crime Bureau (NICB) VIN Check

The NICB offers a free VINCheck service that can help you determine if a vehicle has been reported as stolen or salvaged. While this tool doesn’t provide direct insurance information, it can alert you to potential red flags that may affect a vehicle’s insurability. To use this service:

- Visit the NICB VINCheck website

- Enter the VIN and complete the CAPTCHA

- Review the results for any theft or salvage reports

Contacting Local Law Enforcement

In some cases, local law enforcement agencies may be able to provide information about a vehicle’s insurance status. While this method may not be as convenient as online options, it can be useful if other approaches are unsuccessful. Contact your local police department’s non-emergency number to inquire about this service.

Benefits of Checking Car Insurance by VIN Number

Verifying a vehicle’s insurance status using its VIN offers several advantages:

- Avoid Purchasing an Uninsured Vehicle: When buying a used car, checking its insurance status can help you avoid purchasing a vehicle that may have lapsed coverage or other insurance-related issues.

- Protect Yourself from Fraud: Unscrupulous sellers may attempt to sell vehicles with fraudulent or expired insurance. Checking the insurance status can help you identify potential scams.

- Ensure Compliance with Local Laws: Many jurisdictions require vehicles to maintain continuous insurance coverage. Verifying your own vehicle’s insurance status can help you avoid fines or legal issues.

- Make Informed Decisions: Understanding a vehicle’s insurance history can provide insights into its overall condition and potential risks, helping you make more informed decisions when purchasing or insuring a car.

- Streamline the Insurance Process: When insuring a new vehicle, having accurate information about its current insurance status can help expedite the process and ensure proper coverage.

Limitations of Free VIN Insurance Checks

While free methods to check car insurance by VIN can be helpful, they do have some limitations:

- Incomplete Information: Free reports may not provide comprehensive insurance details or historical data.

- Delayed Updates: Some databases may not reflect the most current insurance information, especially for recently purchased or insured vehicles.

- Privacy Restrictions: Certain insurance details may be protected by privacy laws and not accessible through free public searches.

- Limited International Coverage: Free VIN checks may not always provide accurate information for vehicles from other countries.

Tips for Effective VIN Insurance Checks

To maximize the effectiveness of your VIN insurance check:

- Use Multiple Sources: Cross-reference information from different free sources to get a more comprehensive picture of the vehicle’s insurance status.

- Verify Recent Information: Ensure that the insurance information you obtain is current, as coverage can change rapidly.

- Consider Paid Services: For more detailed reports, consider using paid VIN check services that offer comprehensive vehicle history reports, including insurance information.

- Consult Professionals: If you’re unsure about the results of your VIN insurance check, consult with insurance agents or automotive professionals for guidance.

- Keep Records: Document the results of your VIN insurance checks, including the date and source of the information, for future reference.

Conclusion

Checking car insurance by VIN number for free is a valuable tool for vehicle owners, buyers, and sellers. By utilizing online databases, insurance company websites, government resources, and other free methods, you can access important information about a vehicle’s insurance status and history. While free VIN checks may have limitations, they provide a solid starting point for understanding a vehicle’s insurance situation and can help you make informed decisions about purchasing, insuring, or maintaining a vehicle.

Remember that insurance status can change quickly, so it’s essential to verify information as close to the time of transaction or need as possible. By combining free VIN insurance checks with other research methods and professional advice, you can ensure that you have the most accurate and up-to-date information about a vehicle’s insurance status, helping you navigate the complex world of automotive ownership and insurance with confidence.

FAQs About For Check Car Insurance by VIN Number for Free

1. Is it legal to check car insurance by VIN number?

Yes, checking car insurance by VIN number is legal as long as you use legitimate sources and respect privacy regulations. Many online services and government agencies provide this information for public use. However, it’s important to use the information responsibly and for legitimate purposes only.

2. Can I check the insurance status of any vehicle using its VIN number?

In most cases, yes. The VIN is a unique identifier for each vehicle, allowing access to its specific insurance information. However, some limitations may apply depending on the database or service you’re using, and the availability of information can vary by region or country.

3. Are there any limitations to free VIN checks?

Free VIN checks can provide useful basic information, but they often have limitations. They may not offer comprehensive historical data, real-time updates, or detailed policy information. For a more complete picture, you might need to use paid services or consult directly with insurance companies or relevant government agencies.

4. How often should I check the insurance status of my vehicle?

It’s a good practice to check your vehicle’s insurance status regularly, especially at key times:

- When renewing your policy

- Before and after purchasing or selling a vehicle

- After any major accidents or claims

- If you suspect any issues with your coverage

- At least once a year as a general check

Regular checks help ensure your coverage is current and adequate.

5. Can I check car insurance by VIN number for vehicles outside my country?

While it’s possible to check insurance for vehicles in other countries using the VIN, the process and availability of information can vary significantly. Many international databases exist, but they may not have complete information for all countries. It’s often more reliable to use resources specific to the country where the vehicle is registered.

Marathi author Anju Mary has made a mark in the literary world with her innovative storytelling and deep passion for reading. Her unique narrative style and creative approach offer readers a distinctive and enriching experience, solidifying her reputation as a prominent writer.